FFECON23 Speakers

Ciara Aitchison, Director, Insights and Research, FINTRAIL

Ciara has over 15 years’ experience in banking in both relationship management and financial crime roles, and over 7 years’ financial crime experience across customer due diligence, enhanced due diligence, AML policy and supporting capabilities. In her most recent role she has focused on delivering subject matter expertise through thought leadership content, including submissions to HM Treasury, webinars and international conferences, and the design of industry-leading certification content.

Shilpa Arora, Senior Director, Anti-Financial Crime Segment Solutions, ACAMS

Shilpa is the Anti-Financial Crime Segment Solutions Director for ACAMS where she is responsible for the development of anti-financial crime solutions for ACAMS clients. Shilpa partners with CCOs, COOs and Heads of AFC functions in regulated entities to enable holistic learning, bespoke engagement, best practices and preparing the landscape for AFC professionals of the future. Shilpa leads sales enablement, drives sustainable value for clients and acts as the central point coordinating core offerings. Shilpa represents ACAMS by leading roundtables, speaking at select major industry events, participating in think tanks and proactively engaging with industry practitioners.

Maya Braine, Managing Director, Head of Insights, FINTRAIL

Consultant, investigator, and regional specialist, it’s been Maya’s job for a decade to promote compliance and diligence for financial institutions large and small. She has conducted enhanced due diligence and in-depth compliance assessments for leading international banks, as well as investigations into financial laundromats, and bribery and corruption scandals. Maya is passionate about how innovative financial services can promote financial inclusion and economic development, and her mission at FINTRAIL is to provide compliance solutions that aid, not hinder, world-changing innovation.

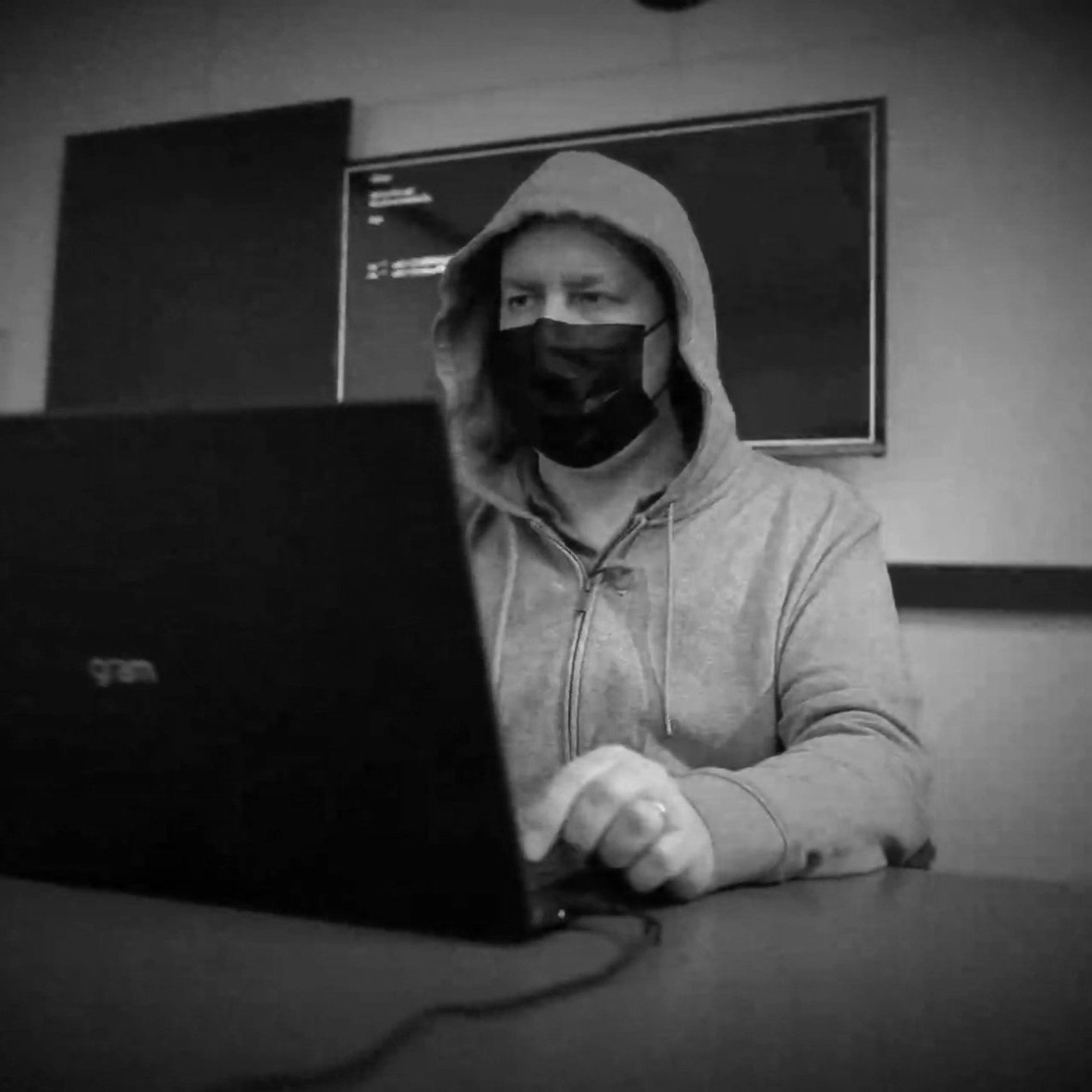

Jim Browning, Scam Baiter and YouTuber

Jim Browning is the Internet alias of a scambaiting YouTuber from the UK whose content focuses on investigating call centres engaging in fraudulent activities.

He has since carried out investigations into various scams, in which he infiltrates computer networks run by scammers who claim to be technical support experts, fake US IRS agent or pretend to be companies like Amazon or Microsoft. Some of the videos feature CCTV footage of the scams in action and has even confronted scammers live on their own CCTV cameras.

Zwelli Burns, Senior Director, Compliance Technology and Crypto, Paysafe

Zwelli is the Senior Director of Compliance Technology and Crypto at Paysafe. He oversees innovation initiatives on compliance controls, digital and emerging payment types and Cryptocurrency services. Zwelli has been working in Financial Crime prevention for the past 13 years. Starting at one of the card schemes, before moving into Banking as a Service, Issuing, Acquiring and operated his own consultancy for 2 years during the pandemic before joining Paysafe.

Amber Burridge, Head of Fraud Intelligence, Cifas

Amber Burridge is the Head of Fraud Intelligence at Cifas, with over fifteen years’ experience in crime and fraud analysis and a Masters degree in Forensic Psychology and Criminology. She has a background of working within law enforcement, local government and private sector. She is the author of numerous Cifas research reports, including Wolves of the Internet – an investigation into where and how fraudsters steal data online – and The Insider Fraud Picture, an in-depth analysis of the internal fraud landscape in the UK. Other publications include Fraudscape, an annual report of fraud trends, as well as the annual Cifas Strategic Intelligence Assessment, highlighting key priority areas for all sectors for the upcoming year. Amber has also appeared as a subject matter expert on the likes of Panorama, Crimewatch and other news programmes.

Ian Christie, Co-Founder, FincSelect

Ian has been recruiting within Financial Crime and Financial Crime Operations for over 7 years. Prior to this, he has 8 years experience working within Corporate and personal financial Recovery and Re-organisation within Consultancy.

Having partnered with numerous Financial Services firms to build out 1st and 2nd line teams either on short or long term programmes, Ian is known as the go to for all things temp in the Fin Crime world. He has passion for the anti-financial crime industry which drives his enthusiasm and technical understanding.

John Christmas, Former Banker, Whistleblower and Co Author of ‘KGB Banker’

John Christmas is a former banker whose banking career ended when his whistleblowing against his employer Parex Bank of Latvia was covered-up by the European Bank for Reconstruction and Development. Later, Parex Bank was named by a Spanish court for providing platform money-laundering accounts for the two top money-launderers from the Tambovskaya Mafia which is closely linked to Vladimir Putin. Meanwhile, Parex activity was spun-off to notorious Ukio Bank of Lithuania, ABLV Bank of Latvia, Citadele Bank of Latvia, and the Danske Bank branch in Estonia. John was educated at Dartmouth College and Cornell University in the United States, and has resided in several European countries. John is co-author of thriller novel 'KGB Banker' which was inspired by his whistleblowing experience.

Eoin Collins, Senior Financial Crime Consultant, FINTRAIL

Eoin has over 7 years’ experience in the regulated financial crime sector, holding both first and second line roles in online marketplaces and merchant acquiring FinTech businesses. Eoin has significant experience in financial crime operations, people management, transaction monitoring and enhanced due diligence programme design and implementation, and payments licence applications and inspections in the UK and Ireland.

John-Paul Eaton, Global Community Director, FINTRAIL

John-Paul is a creative multipotentialite intrigued by anti-financial crime, who has discovered a purpose in blending his unique skill set to create immersive and engaging environments to educate and connect industry professionals. John-Paul is excited to serve both the FINTRAIL and FFE communities as Global Community Director, by building long-term partnerships and curating memorable experiences that the communities will want to share with the anti-financial crime world!

Aaron Elliott-Gross, Partner and Group Head of Financial Crime and Fraud, Revolut

Robert Evans, CEO, FINTRAIL

As co-founder of FINTRAIL, Robert is a leading authority on innovative financial crime compliance, and is responsible for the execution of financial crime compliance projects for clients in Europe, US and Asia. He exploits his knowledge of and experiences within developing and high risk economies, institutional banking and financial services to help FINTRAIL’s clients design, execute and assure financial crime compliance objectives from a business and customer-centric perspective. He is the co-author of the ACAMS "AML for FinTech” courses and co-established the FinTech FinCrime Exchange (FFE), a global network of compliance professionals in the FinTech sector.

Keith Ferguson, Senior Product Manager – Product & Platform, Flutter International, PokerStars

Keith (he/his) is a Senior Product Manager at Flutter International with 5 years of expertise in player verification, KYC, and AML solutions, adeptly navigating stringent regulatory requirements across 20+ regions of the PokerStars brand. Driven by a commitment to enhance the technology suite, Keith focuses on integrating cutting-edge innovations like biometrics and open banking, ensuring exciting player experiences while upholding the highest compliance standards.

With a wealth of knowledge from his career 20 years from Banking to iGaming and a masters in CyberPsychology – he has passion for embracing emerging technologies and is always eager to share his experience and insights.

Riten Gohil, Digital ID, Fraud & AML Orchestration Evangelist, Signicat UK

Riten Gohil has been a leading evangelist in the Digital Fraud, Identity & Authentication space for over 20 years. He is also Fellow of the International Compliance Association (FICA) having sat on many public and private bodies tackling challenges in fraud and financial crime throughout his career.

At Signicat UK, who acquired London-Based Regtech Sphonic in April 2024, Riten works with a team of industry experts delivering its innovative RegTech technology to some of the leading brands in the world. Enabling customised Identity, On-Boarding and Fraud Management tools through its Trust Orchestration platform, Riten and the Sphonic team deliver innovative solutions through a marketplace of over 100 of the leading vendors in the world via a single API.

Prior to Sphonic, Riten worked at Visa Europe leading authentication products into the market such as Visa CodeSure the first industrialised digital display card and the efforts to grow Verified by Visa in Europe as well as numerous other identity and risk management solutions being developed by the scheme.

Riten also worked at APACS (now part of UK Finance) leading industry programmes in the areas of Online Fraud, Insider Fraud and Identity Fraud through collaborative projects between public and private sector, with the latter he chaired the Home Office Identity Theft Consumer Awareness Group from its inception.

Riten's earlier career involved investigative roles with the Serious Fraud Office in the UK and the Organised Fraud Team of DWP, he had some stints with startups such as Flutter.com and Minutepay.fr before the internet became 'a thing'.

Kseniia Kutyreva, Head of Risk & Compliance, FINOM

Ksenia is Head of Risk and Compliance at FINOM. She is passionate about innovation in Fintech and is a strong supporter of girls in tech. Ksenia completed a Master Program in Law and Politics of International Security at the Vrije Universiteit in Amsterdam with a focus on International Blacklisting regimes. She then went on to build her career in Compliance and has experience working for large corporate banks, Payment Service Providers, and AML consultancies in The Netherlands. She obtained a CAMS certification in 2018 and completed the CIPP and CIPM training in Data protection.

Grant MacDonald, Director, FinCrime Market Engagement, Experian

For over 20 years, Grant MacDonald has been pioneering the creation and delivery of market insights across the identity, fraud, financial crime and credit landscape. Grant is responsible for coordinating Experian’s marketing, product, delivery and consultancy efforts to deliver market leading Financial Crime insights and services to UK businesses.

Ronya Naim, Head of Financial Crime (MLRO), ClearBank

Ronya is the MLRO and Head of Financial Crime Compliance at ClearBank, a fintech specialised in payments. She has held financial crime roles at multiple financial institutions over the last 15 years, such as JPMorgan, Barclays, and the Europe Arab Bank, covering a multitude of businesses, including payments, trade finance, corporate banking, lending, and wealth management. In addition to her banking roles, she has also consulted in the Middle East on corruption and AML in the art world. She also holds a postgraduate degree in Social Anthropology of Development from the School of Oriental and African Studies (SOAS), where her dissertation focussed on corruption in the Middle East.

Martin Nordh, CEO and Co-Founder, Acuminor

Martin Nordh is the co-founder and CEO of Acuminor, a regulatory tech company specialising in anti-money laundering, terrorist financing and sanctions. Martin has a background from law enforcement, the justice department and international banking. He has extensive experience in identifying and handling strategic financial crime risks in public and private organisations. He is also an author and international lecturer on the subject of anti-money laundering. Martin holds a LL.M., a BA in Political Science and a Law Enforcement degree.

James Nurse, Managing Director, Consult/Pioneer, FINTRAIL

James has spent the last 10 years working in the regulated financial sector. Having held first and second line roles in the gambling, prepaid card and money transfer industries, James brings a wealth of experience from the fast moving Fintech space. James blends his knowledge of financial crime prevention with an understanding of how technology can support exciting growth in the financial services sector while managing the risks posed by the ever-more innovative criminal schemes we see today.

Vishal Oberoi, Group Head, Compliance, Nexi; Chief Compliance Officer, Nets

Vishal Oberoi is the Group Head of Compliance for Nexi Group, as well as the Chief Compliance Officer for Nets. Prior to joining Nexi/Nets, Vishal was Standard Chartered Bank’s Chief Risk Officer covering Compliance, Risk, Finance and other Functions. He has extensive experience running programs of financial crime compliance, business operations, operational risk and regulatory change management. He is a Certified Anti-Money Laundering Specialist with 20 years of experience in leadership roles for commercial, investment and private banks globally. Prior to Standard Chartered, Vishal has worked with Bank of America Merrill Lynch and Citi in both Hong Kong and New York City.

Nicola Poole, Global Head of New Client KYC Onboarding, Citi

Nicola Poole is the Current Global Head of New Client KYC Onboarding at Citi. Previously, she has held various Executive Client Lifecycle Management (CLM) positions in Financial Institutions and has led teams focused on CLM Transformation and 1st line Operations in KYC, AML Monitoring and Pre/Post trade Client Services.

Throughout her career, she has been actively involved across the industry in the development and implementation of CLM and Client Data Technology and has delivered several successful solutions in her roles.

Nicola is now focussed on the increasing role of Technology and Innovative Fintech to drive financial crime detection, increase protection and enhance the clients’ experience.

Joe Robinson, CEO and Co-Founder, Hummingbird

Joe Robinson is Co-Founder and CEO of Hummingbird, a platform for fighting financial crime. Hummingbird is an anti-money laundering platform used by financial institutions to investigate suspicious activity and fight crime. Innovators in finance including Stripe, Coinbase, Klarna, Affirm, and Evolve Bank & Trust use Hummingbird to power their compliance practice area. Joe was previously VP Risk & Data Science at Circle, a top cryptocurrency company. Prior to that, he worked at Square where he was product lead for Square Dashboard and Square Online Stores.

Samantha Sheen, Director, Ex Ante Advisory Limited

Sam Sheen has been professional involved in risk management, compliance and financial crime prevention for over 15 years, working for a wide variety of financial institutions in various jurisdictions. Holding roles ranging Head of Group Compliance, MLRO, DPO and Head of Transformation Implementation, Sam takes a pragmatic and forward-looking approach towards the interpretation and application of AML/CFT regulatory requirements. Sam's scope of work extends to advising both FinTechs, VASPs and RegTech providers to support them in tackling fit for purpose design requirements, operational challenges and unanticipated bumps along the AML/CFT compliance highway as their businesses scale. Having also worked as a AML/CFT supervisor, heading Enforcement, AML/CFT and most recently cross sectoral Supervision Divisions, Sam works closely with regulators and other agencies across Europe and beyond on everything from conducting sectoral assessments of the virtual asset sector to improving the use of data in the risk assessment and monitoring of obliged entities. Sam's work includes co-authoring various training courses for ACAMS and working with both financial institutions and regulators on the application of sanction restrictions and the detection of evasion tactics. Originally from Montreal, Canada Sam regularly chairs AML/CFT-themed events, provides engaging training to both the public and private sector, produces and contributes to innovative AML/CFT thought leadership publications and is an all-round champion of stakeholders who put in the hard yards to detect, prevent and disrupt financial crime.

Che Sidanius, Global Head of Financial Crime & Industry Affairs, Refinitiv

Che Sidanius is the Global Head of Financial Crime & Industry Affairs at Refinitiv (an LSEG business). His role is to identify regulatory changes and lead programs of action with the sole purpose of enhancing the fight against financial crime more effective and delivering the best possible outcome for the industry. Together with the World Economic Forum and Europol, he’s the founder of the Global Coalition to Fight Financial Crime and Co-Chair of the B20’s Integrity and Compliance Taskforce.

Prior to joining Refinitiv, his work experiences include being a Senior Advisor to the Bank of England's Financial Stability Directorate and previously a Senior Bank Examiner at the Federal Reserve Bank of NY. His most notable awards included receiving the Presidential Award for managing the 2007-09 Financial Crisis and a driving force behind Refinitiv’s Impact Company of the year award in 2019 and contributor to the same award in 2021.

Che received his Master’s in International Affairs from the School of Advanced International Studies, Johns Hopkins University and undergraduate degree in Political Science from UC Berkeley in California.

Bernadette Smith, Director of Financial Crime Risk & MLRO, Starling Bank

Simon Taylor, Head of Strategy and Content, Sardine

Simon is the Head of Strategy at Sardine, the world's best fraud and risk team you hire as an API. Simon is best known for Fintech Brainfood the weekly newsletter with 30k+ subscribers. Before Sardine Simon co-founded 11:FS and led Crypto R&D and launched Rise for Barclays. With 20 years in Fintech and Finance, Simon is a self confessed Fintech Nerd.

Kathryn Westmore, Senior Research Fellow, Centre for Financial Crime and Security Studies (CFCS), RUSI

Kathryn is a Senior Research Fellow at the Centre for Financial Crime and Security Studies (CFCS) at the Royal United Services Institute (RUSI), a military and defence think tank. The CFCS is a research programme dedicated to studying the intersection of finance and national security. Kathryn’s research focuses primarily on the policy, regulatory and industry interventions required in order to minimise the use of the UK financial system to facilitate financial crime, including fraud, money laundering and corruption. She has recently served as the Specialist Advisor to the House of Lords Committee on Digital Fraud. Prior to joining RUSI, she spent 15 years as a financial crime consultant at PwC. She has experience of working across the regulated sector, advising institutions on how best to manage their financial crime risks and meet their regulatory obligations. She also has led large and complex investigations into allegations of fraud and corruption both in the UK and overseas.